by Nitin Arage | Feb 16, 2025 | General

In today’s fast-paced business environment, organizations are continually seeking ways to enhance efficiency, reduce costs, and maintain a competitive edge. One critical area ripe for improvement is the Purchase to Pay (P2P) process, which encompasses the entire procurement cycle—from purchasing goods and services to processing supplier payments. Traditional manual P2P processes are often fraught with challenges, including delayed approvals, data entry errors, and lack of real-time budget visibility. These issues can lead to financial discrepancies, strained supplier relationships, and missed opportunities for cost savings.

Recognizing these challenges, forward-thinking organizations are turning to automation solutions to streamline their P2P processes. One such solution is WareConnect, developed by DataDevice, which offers comprehensive automation tailored to integrate seamlessly with Microsoft Dynamics 365 Finance.

Understanding the Purchase to Pay Process

The P2P process is a vital component of an organization’s operations, involving several key stages:

- Purchase Requisition: Employees identify the need for goods or services and submit a purchase request.

- Purchase Order (PO) Creation: Upon approval of the requisition, a formal PO is generated and sent to the supplier.

- Goods Receipt: The organization receives the goods or services and verifies them against the PO.

- Invoice Processing: The supplier submits an invoice, which is matched against the PO and goods receipt for accuracy.

- Payment Processing: After validation, payment is made to the supplier as per agreed terms.

Each of these stages, when handled manually, can introduce delays and errors, impacting the organization’s financial health and operational efficiency.

The Case for Automation

Automating the P2P process offers numerous benefits:

- Efficiency Gains: Automation reduces manual data entry, accelerates approval workflows, and minimizes processing times.

- Enhanced Accuracy: By eliminating manual intervention, the risk of errors in data entry and processing is significantly reduced.

- Real-Time Visibility: Organizations gain instant access to procurement data, facilitating better budget management and decision-making.

- Cost Savings: Streamlined processes lead to reduced operational costs and the ability to capitalize on early payment discounts.

Introducing WareConnect

WareConnect is a robust automation solution designed to optimize the P2P process.

Key features include:

- Purchase Request Module: Allows users to create and submit purchase requests with automated budget allocation based on supplier, cost center, and item number.

- Automated Approval Workflows: Ensures purchase requests and invoices are routed through predefined approval hierarchies, enhancing compliance and control.

- Invoice Management: Automates invoice import, validation, and matching against POs and goods receipts, reducing manual effort and errors.

- Real-Time Integration: Seamlessly integrates with Microsoft Dynamics 365, providing up-to-date financial data and budget insights.

Real-World Impact: Collingwood Football Club’s Success Story

A prime example of WareConnect’s effectiveness is its implementation at the Collingwood Football Club (CFC). CFC faced challenges with manual procurement and expense processes, leading to inefficiencies and financial oversight issues. By adopting WareConnect, CFC achieved:

- 85% Reduction in Procurement Approval Time: Streamlined workflows enabled faster decision-making.

- Automated Invoice Processing: Reduced manual data entry and accelerated payment cycles.

- Real-Time Budget Validation: Enhanced financial control and prevented overspending.

This transformation not only improved operational efficiency but also strengthened supplier relationships and provided CFC with greater financial oversight.

Conclusion

Incorporating automation into the Purchase to Pay process is no longer a luxury but a necessity for organizations aiming to thrive in today’s competitive landscape. Solutions like WareConnect offer a pathway to enhanced efficiency, accuracy, and financial control. By embracing such technologies, businesses can focus on strategic initiatives, drive growth, and maintain a robust financial foundation.

For organizations seeking to modernize their procurement and financial workflows, exploring the capabilities of WareConnect could be a transformative step toward achieving operational excellence.

by Nitin Arage | Jul 30, 2023 | General

In today’s fast-paced digital world, businesses are constantly seeking ways to streamline their operations and enhance productivity. One area that often involves manual effort and potential errors is the creation and approval process of the EFT Bank Upload Summary Report. WareConnect, a solution from DataDevice Pty, by embracing digital solutions, such as digitally compiling a summary report of open invoices, submitting it for electronic approval, automatically marking invoices as paid, and generating cheques with email remittance advice, organizations has simplified and optimized financial workflows.

Traditionally, the creation of the EFT Bank Upload Summary Report involves manual gathering and compilation of open invoices to be paid. This manual process is not only time-consuming but also prone to errors. By digitizing this process, organizations can significantly improve efficiency and accuracy.

Implementing WareConnect, businesses can compile a summary report of open invoices to be paid in the bank via an ABA file upload. This digital compilation pulls invoice details directly from the accounting or invoicing software, ensuring up-to-date and accurate information. The report includes essential details such as payment amounts, due dates, and vendor information, all conveniently accessible in a centralized platform.

The next step in streamlining the process is implementing an electronic approval system. Instead of relying on manual signatures or physical documents, this digital workflow allows authorized personnel to review and approve the summary report electronically. Approvers can access the report online, examine the details, and provide their approval with just a few clicks. This eliminates the need for paper-based approval processes and enables faster decision-making.

Once the summary report has received electronic approval, the system automates the invoice payment process. By generating ABA files compatible with the bank’s upload requirements, organizations can seamlessly transfer the payment information for processing. The system maps the relevant invoice data to the appropriate fields in the ABA file, ensuring accuracy during the upload.

Simultaneously, as the payments are confirmed by the bank, the system automatically marks the corresponding invoices as paid in the accounting software. This eliminates the need for manual entry and reduces the risk of errors in recording payments.

For payments processed through EFT, the system can auto-create cheques with all the necessary payment details. This automation saves time and effort in generating and printing physical cheques manually.

In addition to cheques, the system also generates email remittance advice. These electronic notifications contain comprehensive payment information, invoice references, and any additional relevant details. By emailing the remittance advice directly to the vendors, businesses can improve communication, reduce queries, and enhance transparency.

In conclusion, by simplifying and digitizing the EFT Bank Upload Summary Report process, organizations can streamline financial workflows and improve efficiency.

To know more…book a demo for “WareConnect for Databuild”, by calling us at +61 (02) 8377 6448

by Nitin Arage | Dec 18, 2022 | General

Emma Thompson, the British actress, and screenwriter said “Being disabled should not mean being disqualified from having access to every aspect of life.” In this spirit, it is only appropriate that, in the year 2013, the Australian government established The National Disability Insurance Scheme (NDIS), which is run by the National Disability Insurance Agency (NDIA), funding reasonable and necessary supports and services that relate to a person’s disability to help them achieve their goals.

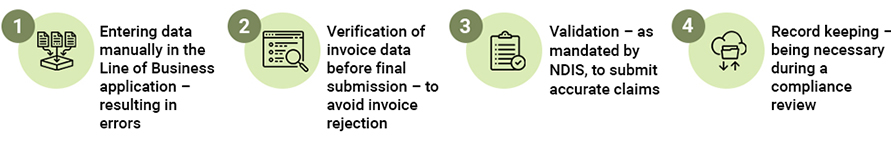

Since you, as Plan Manager, are already a part of NDIS you know all that is to be known about the NDIS program. So, let’s instead look at the issues faced by Plan Managers while processing NDIS invoices submitted to them by Plan-managed participants. We at DataDevice Pty, an Australian company, based in Sydney, have been working closely with Plan Managers – My Plan Manager our client, and with Windgap Foundation Limited (currently in final talks with them). We found that the four major bottlenecks, taking up valuable time and resources are:

Let’s take a look at each.

The first issue of manually entering data, resulting in errors, can be resolved by opting for an automatic data extraction application like Abby Flexicapture. This requires setting up the application and DataDevice, having been a Platinum partner of Abbyy for the last 15 years, can help you achieve that. Also, some vendor invoices need to be “trained” to correctly extract the required data. We offer these services too.

The second, Verification of invoice data, can be sorted by employing resources in the form of Verification Operators who verify the extracted invoice data and correct it wherever necessary before submitting the same to the myplace provider portal. Also, to find which vendor invoices that need training, verification is necessary.

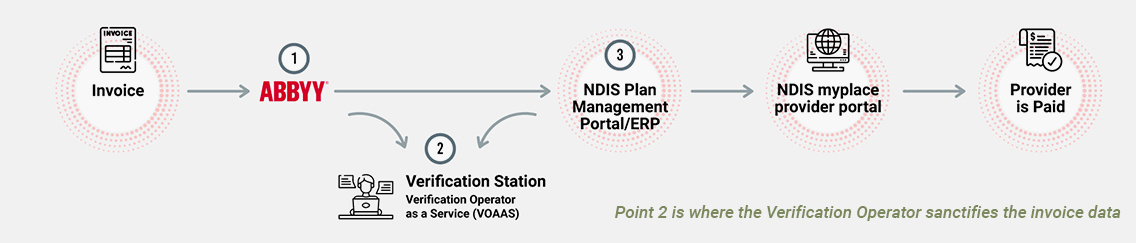

Eventually, if you enter NDIS invoice data manually or use any data extraction application, verification of invoice data is a must to avoid rejection of the invoice thus introducing a delay in payment to the vendor. To make verification accurate and economical, DataDevice offers Verification Operators as a Service (VOaaS). The flow can be depicted graphically,

We closely follow NDIS instructions and those you gave to verify and correct the NDIS invoices. The typical NDIS Invoice Data Extraction and Verification fields are:

And for each Service provided (Table Line Items)

-

support Start Date & Support End Date

-

support Code listed in the NDIS Support Catalogue

-

support Description

-

quantity

-

unit Price

-

total Invoice Amount

-

GST component if applicable

Also, the third, Validation, is also taken care of by Verification Operators. They verify the mandatory fields mentioned below so that you as Plan Manager can take corrective actions:

-

has the NDIS plan expired or is active?

-

is the price correct and the hourly breakdown provided?

-

are there enough funds in the NDIS plan?

-

is a correct start and end date provided in the invoice?

-

was the service provided under a single plan?

-

are any mandatory details missing?

And finally, the fourth, Record keeping is very essential to prove that your claims for the support delivered to NDIS participants are correct. The following records need to be maintained:

Providing this documentation allows NDIS to verify the quantity, type, and duration of the support delivered if you are selected for a compliance review.

DataDevice can help you by providing a repository for all the records, on your server, with an easy Search and Retrieve facility.

Further, as you are aware that the NDIS has stringent rules and regulations in place around invoices. And, Plan Managers are responsible for ensuring that claims for payment are complete, truthful, and accurate.

Towards this end, our Verification Operators diligently review each claim for compliance and apply corrections wherever necessary, before they are submitted to the myplace provider portal. This means that the vendor payment period is optimised with less likelihood of any claim being rejected.

Using our Verification Operators, you:

- ensure prompt Vendor payments

- assure that Participants need not worry about their budgets but focus on their goals

- save on OPEX (Operating Expenditure)

- save Time

- save Money

- outsource Hiring

- outsource Training

- save on HR activities.

Onboarding Process

We source potential candidates and as part of the interview process put them through a practical test. Next, we get the worker clearances completed as advised by the Plan Manager and get the Police Character Certificate (PCC).

Once the candidate is selected, we provide them with a laptop, install licensed Software & Secure Access, set up DataDevice’s standard tools and set up tools/systems specific to you.

As part of induction, we provide Client Orientation and Client specific training so that he is ready to take up your tasks. After this, the candidate goes live by starting to process the NDIS invoices and related tasks.

Powerful Access Security

Security tech like Cisco Duo is used to limit access to passwords, other important credentials, and file access. We Protect your data with simple yet powerful access security.

Our modern access security is designed to safeguard all users, devices, and applications —so you can remain assured about the security of your application and data.

We lay the foundation for your zero-trust journey with multi-factor authentication, dynamic device trust, adaptive authentication, and secure single sign-on for every user and device. This makes work from anywhere possible with perimeter-less workforce protection and worldwide secure access.

Pod-based efficient Workforce Management

The total workforce is divided into a manageable number of employees called Pod. Every Pod has a dedicated Supervisor who trains, answers queries, motivates, and manages the employees in the Pod. Also, a Manager manages all the Supervisors and talks to the client in real-time.

We also maintain a trained “Bench” Pod. This Pod remains on standby but swings into action as soon as some employee from a regular Pod is sick or has to remain away from work for any reason. The best part is that we do not charge you for this “Bench” Pod! We absorb this cost so that your work continues smoothly without break.

Employee benefits

Every month the Pod meets, in person, to have fun and strengthen the bond between themselves and the Supervisors.

Also, every month one Most Valuable Player (MVP) is nominated from each Pod. To be worthy of becoming an MVP the employee has to achieve error-free targets. The MVP is rewarded with Amazon Gift Vouchers. It is considered a matter of pride to be nominated as an MVP!

We understand that at times the job can be very stressful. Therefore, we arrange monthly Yoga Sessions as part of Stress Management.

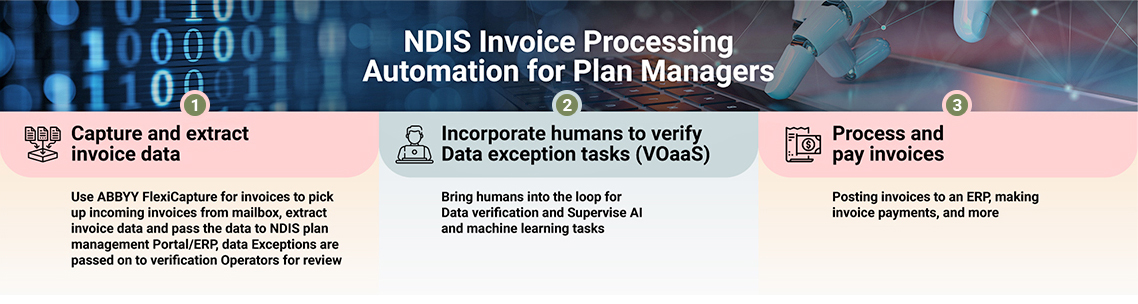

To sum up, the below diagram depicts the NDIS invoice processing automation for Plan Managers:

For more information and to book a demo of this solution, Contact us at +61 (02) 8377 6448

by Nitin Arage | Sep 12, 2020 | General

Faisal R. Bajwa, group controller manager at Khan’s SUPA IGA Supermarket Group faced an ongoing issue of submitting and approving invoices between store locations and its head office as it required a substantial investment in resources. Also, collating weekly documents and their storage was a tedious manual process that lacked transparency and represented a significant cost per store.

Faisal, reached out to DataDevice Pty, a software house, with these issues.

The software house appointed their business analyst to gain an in-depth knowledge of the supermarkets current as is process and create scope of works. The study revealed that Laserfiche was the right solution to resolve the issues. Having expertise and experience in Laserfiche products, DataDevice demonstrated Laserfiche solution to Khan’s SUPA IGA Supermarket Group and later helped carry out user acceptance testing.

On acceptance, DataDevice began implementation of Laserfiche at Khan’s SUPA IGA Supermarket Group, which currently operates 11 supermarket locations across NSW, Australia, providing a wide range of products and value-added services at each location and staffing over 800 people across all stores. Laserfiche products, were used to implement an automated solution for invoice processing, reconciling the invoices by matching them with the appropriate statements, storage of documents and generating reports in order to optimize company resources and increase transparency. DataDevice imparted the required training to IGA Khan’s employees to quickly get them started using Laserfiche solution.

Bajwa is of the opinion that using Laserfiche, important documents are now quickly uploaded and delivered to the head office, significantly reducing labor costs and paperwork, and allowing them to make prompt decisions and improve key business relationships.

During the COVID-19 pandemic, Khan’s SUPA IGA’s decision to implement Laserfiche was instrumental in enabling the company to manage a 600% increase in work volume – compared to the same period last year — with the same amount of staff in a highly efficient and cost effective manner.

But, what exactly was involved in this implementation?

Implemented invoice collection, approval and storage workflow, saving time and money

Due to lack of digital document and records management system, it took a 10 hour drive to deliver paper invoices from remote store branches to the Head office, on a regular basis. On arrival, the paper invoices had to be sorted and submitted for review and approval to different members of the finance team. These challenges represented a huge investment in time and company resources, and also resulted in a lack of transparency. Thus the manual invoice approval system was inefficient and tedious.

DataDevice assisted Khan’s SUPA IGA to recognize an opportunity for digitally transforming the creditor invoice approval process, and to decide to implement Laserfiche enterprise content management (ECM) system for its expansive document storage and workflow modelling capabilities.

The ability to upload and store invoices in one central location has helped the finance team and auditors to easily search and instantly access invoices and related information.

Later, Bajwa said that Laserfiche could not only hold documents, but the workflow modelling tool and the ability to use data and scripting to generate reports, as demonstrated by DataDevice, was a huge advantage.

Implemented digitisation of store inventory, reducing the time spent in stock-taking and helped control purchases

With fully digitised and automated invoice approval process, after the finance manager performs a general review of received invoices, they are scanned into the Laserfiche repository. A Laserfiche Workflow completes the invoice approval process and exports to a third-party accounting program called Attache.

As all invoices are processed in real time as they arrive at each store location, Khan’s SUPA IGA now has a more accurate view of products purchased and their quantity. This has allowed the organization to reduce the frequency of in-store inventory, and has resolved issues of over-purchasing.

Implemented reporting feature of Laserfiche rendering greater visibility and control of company finances and resources

Laserfiche analytics has many reporting features like estimating time to complete future tasks, Identifying inefficiencies and hidden opportunities, profit and loss (P&L) reports and many others. These features have served the organization to have better control over company finances, to streamline resource allocation and to control in-store operations.

Implemented employee safety measures during the COVID-19 outbreak, avoiding loss of work time due to sickness

The company’s decision to digitise documents and implement touchless invoice approval process and statement matching has improved occupational health and safety standards during the COVID-19 pandemic. Since all documents, invoices and statements are digitised, there is no need to handle and exchange paper documents. All processes are carried out with zero physical contact.

In addition to achieving business continuity, this has arrested the spread of the virus, and allowed the employees to work from home, helping the community at large.

Implemented Laserfiche features helping save one full-time equivalent (FTE) and AU$280,000, per year, in other costs

Khan’s SUPA IGA purchases lot many products from huge product distribution companies like Metcash and has to reconcile the invoices by matching them with the appropriate statements or goods receipts. This, apart from invoice approval and managing documents physically, represents a huge workload. Laserfiche has helped address this by automating the processes, saving employees up to four days of efforts. Apart from saving time and increasing transparency, it has reduced costs, helping the company save AU$280,000.

As for the time, Khan’s SUPA IGA Supermarket Group uses this saved time to improve supplier relationship and offer better service to customers. As for the cost, the company has saved one FTE and additional AU $280,000. As for the health and safety of Khan’s employees, and the communities they serve, the benefit of the implementation is priceless.

For more information and to book a demo of this solution, Contact us at +61 (02) 8377 6448

by Nitin Arage | Jul 29, 2020 | General

“Waiting for the invoice to be approved!”

if, most of the time, this is your work status, then you must be using a manual invoice approval system. The casual approach of this process is tiring as it eats up your precious time which results in missed payment deadlines and losing early payment discounts. Also, the constant delay in payments leads to unhappy suppliers and smashes your brand image.

Moreover, nobody knows where the paper invoice, pending for approval, is at any point in time. Maybe it is lost, or the approver has not seen it yet or has forgotten to approve it. And if the approver is out of office then has an interim approver been nominated? There is no visibility. And again, if the approver requires any clarification, then he must send the invoice back to the originator, with almost illegible scrawled notes, starting an exhausting merry-go-round.

Furthermore, a non-standard, hard to audit, manual approval process leaves the door wide open for Invoice fraud.

Using email as a system for invoice approval has failed to offer any relief as multiple emails need to be exchanged to get the work done. Also, it is difficult to extract information buried among tons of emails. Excel too proves inefficient as all data needs to be recorded manually and further needs to be updated at every step.

Then how do we efficiently manage approval of invoices? Do not despair, there is a solution.

Automate your invoice approval system for Databuild or for any other accounting program like MYOB / Xero / QuickBooks / NetSuite and breathe easy!

Here an invoice, received from a vendor, automatically enters a multi-level invoice approval workflow, and is routed to the first approver based on the business rules – it can be routed based on Job-code, cost center, supplier, department, or dollar value. Next, an intimation is automatically emailed to the approver to review. He can then access the workflow, from anywhere, even on a mobile, and approve, reject, or hold the invoice with neatly typed comments.

If the invoice is approved, it is sent to the next approver in sequence. If rejected it is pushed back in the workflow to be rectified. Alternately, it can be marked as hold, sending it to a designated area while, let us say, waiting for a credit note.

Eventually all approved invoices are automatically exported to Databuild or an accounting application.

In the approval stage following tasks are performed:

-

-

Match invoice with PO – Invoice is visible adjacent to the Purchase Order for easy comparison of items, quantity and amounts. For any discrepancy, the system too generates an error message. Once matched, the approver approves the invoice.

-

-

Manage invoices without PO – If for some reason a purchase order does not exist for an invoice then the approver parks that invoice in the Hold area. The manager then creates a PO in Databuild and matches it with the invoice and approves.

-

-

Check for duplicates – System automatically checks if the invoice is already processed for payment or if a duplicate invoice exists in system or in Databuild. If yes, then the invoice is deleted, sending the invoice out of the workflow, averting double payment.

-

-

Manage supplier credits – An approver can stop an invoice from being processed if a credit note is awaited. He then temporarily places the invoice in Hold area. On receipt of the credit note the invoice is matched and approved.

-

-

Check for overbudget – Invoice amount is automatically checked against the allocated budget defined in Databuild. If it is over the limit, then it is stopped from being processed and parked in the Hold area for appropriate action.

-

-

Pay an invoice partially – Sometimes it is a business need to pay an invoice partially. The approver enters the amount to be paid and approves the invoice for partial payment. The system remembers all the partial payments, displaying this information next to the invoice, for easy reference. Again, an invoice can be split any number of times and be seamlessly paid.

-

-

Export to Databuild – Based on the business rules, the system checks and validates the PO and invoice data. If found correct then touchless export to Databuild occurs, else it is routed to an approver. Then the approver must correct the error and approve, after which the invoice data is automatically exported to Databuild.

This automated multi-level approval system, with systematic routing, forces standardization thereby increasing quality. By its very nature, it is well-defined, dependable process, guaranteeing accurate and timely payments. This further helps gaining early payment discounts on the invoices.

Built-in visibility helps track the invoices. You know where the invoice was, where it is now and where it is going next. This compels compliance and timely completion of the task. Automatic periodic reminders further help approvers stay on top of their tasks, saving time which they can use for other productive tasks.

Moreover, an approver can raise queries and quickly receive clarifications via comments. With clear comments all information is in hand.

Also, with this efficient system you can be assured that all the supporting documents are in place and due diligence is performed.

This system automatically maintains an audit log of who did what and when, eliminating the chances of invoice fraud. The information gathered is generated as an Audit report along with comments which give context to the approver’s actions. The report can be customized to inform you of the number of pending, approved and rejected invoices as well as their dollar value. Importantly, these reports help you monitor and control the cash flow.

The approval workflow can be defined with a couple of clicks. In no time you can appoint an interim approver if the original approver is on vacation or out of office, ensuring your business runs smoothly.

So, with an automated invoice approval system, your cost of processing the invoices decreases, total number of invoices processed per person increases and your work status is always “Job completed!”. And, not to forget the happy suppliers and an enhanced brand image.

For more information and to book a demo of this solution, Contact us at +61 (02) 8377 6448

by Nitin Arage | Jun 14, 2020 | General

Enterprises using automated invoice processing systems can see 81% lower processing costs and 73% faster processing cycle times, as per ABBYY. These figures are compelling. Looking at these numbers any business would want to replace their manual invoice processing with an automated one.

If your business is Building & Construction, then chances are, you are using Databuild for your day to day work management. If so, then now, you can complement Databuild with an efficient invoice automation system, to replace costly manual data entry. But what is automated invoice processing?

Automated invoice processing system starts with early, centralized capture, extraction, verification, and validation of data from subcontractor/supplier invoices. This reduces your cost to record & pay invoices and improves visibility into payment cycle. In addition, this increases the accuracy of analysis and forecasting.

This system, for Databuild, allows users to setup workflows to automate multi-level invoice approval processes. This helps, to get documents routed for approval quickly, visibly, and efficiently, to get supervisors and managers notified via email, and eventually to get invoices automatically named and filed for archival.

On approval, the invoice data gets seamlessly exported to Databuild and MYOB/Xero/QuickBooks/NetSuite

Most importantly, it is an almost a touchless system that carries the invoice data from Capture to Export in no time.

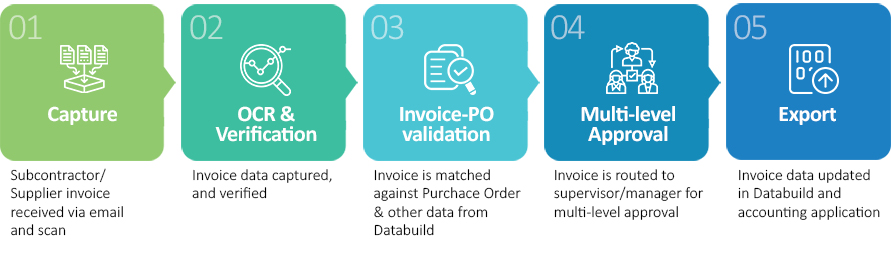

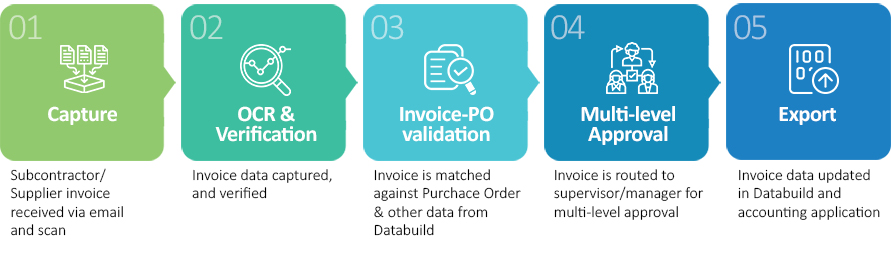

This can be depicted in a flowchart:

Let us look at the features of this flowchart:

Capture

First step is to Capture the subcontractor/supplier invoice received as an email attachment. The system looks for an invoice every few seconds and auto imports it for further processing. Invoices, sent from anywhere, are captured centrally, in the same email inbox.

OCR & Verification

Second stage is OCR (Optical Character Recognition). As the invoice is an image, it is processed by the OCR engine to extract critical data. The extracted data is then verified to maintain data sanity. Here one more critical check takes place – duplicate invoice check. The system validates if the invoice in question is already present in the invoice processing system or Databuild. If yes, then an error is thrown, and double payment for that invoice is averted.

Invoice-Purchase order validation

The third leg of the invoice processing system carries out a real-time lookup in Databuild to validate:

- if the amounts in purchase order and Invoice match.

- if the amounts in purchase order match with the amounts of an already billed, past invoice.

- if the budget in Databuild, for that Job code, is under the allocated budget.

- if the supplier mentioned in the invoice is the same as that in the purchase order.

- if the Job code mentioned in the invoice is the same as that in the purchase order.

- If the due date is correctly calculated based on that supplier’s payment strategy.

For any validation error the system throws an error.

Multi-level Approval

Next, for any validation error, the invoice is sent to the approval workflow and an intimation is automatically emailed to the approver. He can then access the workflow, from anywhere, to approve that invoice by correcting the anomalies. Additionally, more than one approver can be configured for multi-level approvals. Once all approvers approve the invoice it is forwarded to the final step.

Export

Finally, approved invoice data is exported to Databuild. However, as most businesses using Databuild also deploy an accounting application like MYOB/Xero/QuickBooks/NetSuite, the invoice data is also posted to that accounting software. Lastly, the invoice is named and filed for easy search and retrieval.

These components form the backbone of the automated invoice processing system.

As with any new system, the change-over from manual to automated invoice processing requires correct planning. If implemented correctly, with required customizations, the system can lower processing cost per invoice and increase efficiency with faster processing cycle times.

To know more…book a demo for “WareConnect for Databuild”, by calling us at +61 (02) 8377 6448